About Billy

Billy joined the Parachute Regiment in 1983 and served until 1991. He held an array of positions, including Patrol Commander for operational tours in many worldwide locations and also served as a training instructor for the Regiment as a military specialist.

After passing selection, Billy joined the SAS in 1991 as a Mountain Troop specialist.

He has been responsible for planning and executing strategic operations and training at the highest level in numerous locations (Iraq, Afghanistan, South America and Africa). Furthermore, he has led countless hostage rescues.

As a result, he has received numerous awards, including the Queen’s Commendation for Bravery and an MBE presented to Billy by Her Majesty Queen Elizabeth II.

Billy is a certified SF and Counter Terrorist Sniper Instructor, Advanced Evasive Driving Instructor, Tracking/Jungle Warfare/Navigation Instructor, Demolition/Sabotage Instructor, Mountaineering/Rock Climbing/Abseiling/Ice climbing Instructor, Combat Survival/RTI Instructor, Counter Terrorist Instructor (all options) and worked as a Patrol Medic/Trauma Life Support agent for five hospital attachments.

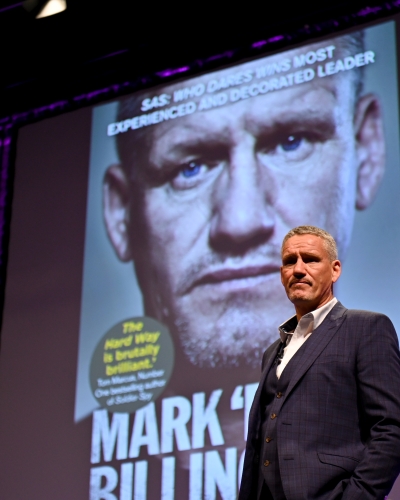

A decorated military leader, Billy served over 20 years in the SAS.

‘The SAS and all it stands for is exemplified in men such as Billy Billingham. They are the backbone of the British military, and I, for one, am thankful he is on our side!’

Sir Ranulph Fiennes Bt OBE

Celebrity Bodyguard

After his military career, Billy became a bodyguard and looked after A-list celebrities such as Sir Michael Caine, Hulk Hogan, Kate Moss, Russell Crowe and Tom Cruise. Furthermore, Billy was bodyguard and Head of Security to Brad Pitt and Angelina Jolie.

SAS: Who Dares Wins (UK)

Billy is TV’s most experienced, highest ranking and most decorated SAS leader and SAS instructor.

He is Chief Instructor on Channel 4’s hit show SAS: Who Dares Wins, alongside DS Rudy Reyes, Jason Fox and Chris Oliver.

Based on elements from Special Forces Selection, the Directing Staff put civilians and celebrities through an eight-day selection process testing the candidates mentally and physically.

During the most recent series, the elite team of ex-special forces operators put recruits to the ultimate test in the unforgiving and epic backdrop of the Jordanian desert.

Series 8 of SAS: Who Dares Wins returns to UK screens in 2023.

Special Forces: World’s Toughest Test (USA)

Premiering in Jan 2023, Billy is a DS in this all-new Fox TV series in which household names endure some of the harshest, most gruelling challenges based on the Special Forces selection process.

There are no votes and no eliminations – just survival.

The only way for recruits to leave is to give up on their own accord through failure, potential injury, or by force from the DS.

The test is physical and draws on mental and emotional strength that ultimately reveals the deepest and truest character of the recruits.

This show is unlike any other – there aren’t producers, fancy hotels, craft services…and no glam.

16 Celebrities, No Prize, No Ego, No Holding Back!